Budgeting doesn’t have to be complicated. The 50/30/20 rule is a simple yet powerful method that helps you manage your money without feeling overwhelmed or restricted. Whether you’re a budgeting beginner or looking to streamline your finances, this strategy can offer clarity, balance, and control.

In this article, you’ll learn exactly how the 50/30/20 rule works, how to apply it to your own budget, and how it can lead to better financial decisions.

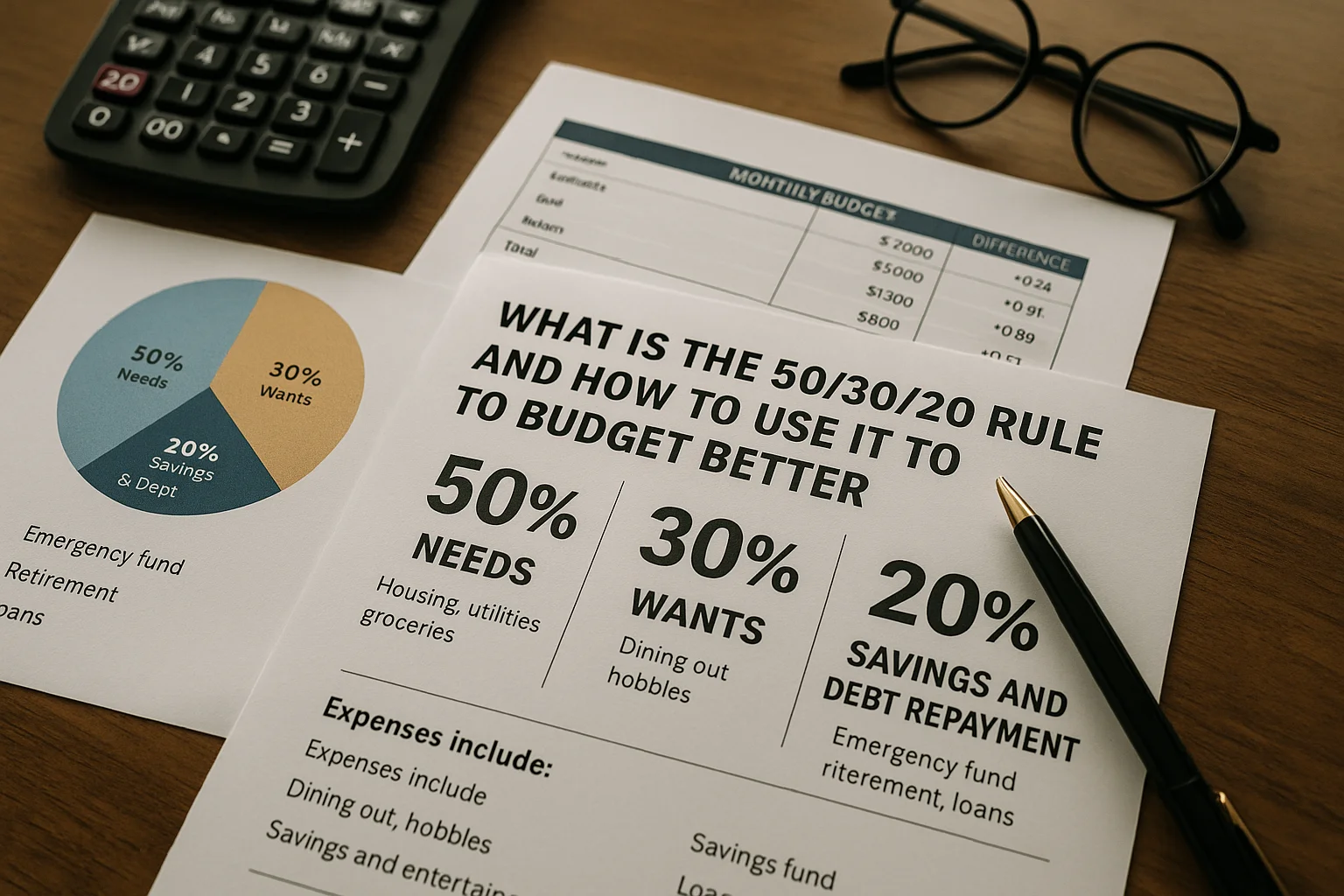

What Is the 50/30/20 Rule?

The 50/30/20 rule is a budgeting technique that divides your after-tax income into three categories:

- 50% for Needs

- 30% for Wants

- 20% for Savings and Debt Repayment

It was popularized by U.S. Senator Elizabeth Warren and her daughter Amelia Warren Tyagi in their book All Your Worth: The Ultimate Lifetime Money Plan.

This method is designed to help you maintain a healthy balance between enjoying your income and being financially responsible.

Step 1: Calculate Your After-Tax Income

To apply this rule, start with your net income — what you take home after taxes, retirement contributions, and health insurance deductions.

Example:

If you earn $3,500 per month after taxes:

- 50% = $1,750 (Needs)

- 30% = $1,050 (Wants)

- 20% = $700 (Savings/Debt)

Step 2: Define Your “Needs” (50%)

Needs are essentials — the expenses you must pay to live and work. If you don’t pay them, you risk serious consequences.

Common “Needs” include:

- Rent or mortgage

- Utilities (electricity, water, gas)

- Basic groceries

- Transportation (gas, public transit)

- Insurance premiums

- Minimum loan payments

If your needs exceed 50% of your income, consider:

- Downsizing housing

- Refinancing debt

- Finding cheaper transportation options

Step 3: Identify Your “Wants” (30%)

Wants are non-essential expenses — things you enjoy but could live without. They’re not bad; in fact, this category helps you enjoy life while staying financially healthy.

Examples of “Wants”:

- Dining out

- Streaming subscriptions (Netflix, Spotify)

- Travel and vacations

- Gym memberships

- Hobbies and entertainment

- Upgraded electronics or clothes

Tracking your wants can highlight areas to cut back if you ever need to save more aggressively.

Step 4: Allocate to Savings and Debt Repayment (20%)

This final portion of your income goes toward securing your financial future.

Use this 20% for:

- Building an emergency fund

- Retirement savings (IRA, 401(k), etc.)

- Paying off credit card or student loan debt

- Investing

- Saving for a large future purchase (e.g., house, car, wedding)

This category is what builds long-term wealth and protects you in emergencies.

Why the 50/30/20 Rule Works

- Simplicity: Easy to remember and apply

- Balance: Helps you enjoy your money while saving

- Flexibility: Adaptable to different incomes and lifestyles

- Structure: Keeps you from overspending in one area

It’s not rigid — if your goals demand more aggressive saving or if you live in a high-cost area, you can modify the percentages.

When the Rule Might Not Fit Perfectly

The 50/30/20 rule is a general guideline. It may not work perfectly if:

- You live in a city with high housing costs

- You’re aggressively paying off debt

- You have inconsistent income

- You’re supporting dependents

In these cases, adjust the percentages while maintaining the core principle: balance between necessities, enjoyment, and future planning.

Tips to Make the 50/30/20 Rule Work

- Automate Your Savings: Set up automatic transfers to savings or retirement accounts.

- Use Budgeting Tools: Apps like Mint, YNAB, and EveryDollar help you track by category.

- Review Monthly: Your budget should evolve with changes in income or expenses.

- Start Small: If you can’t hit 20% savings right away, start with 5–10% and work your way up.

- Be Honest with Categories: Don’t label “wants” as “needs” to justify overspending.

Real-Life Example

Income after tax: $4,000/month

- Needs (50%) = $2,000

- Rent: $1,200

- Utilities: $150

- Groceries: $400

- Insurance: $100

- Transportation: $150

- Wants (30%) = $1,200

- Restaurants: $300

- Subscriptions: $50

- Travel fund: $300

- Gym: $50

- Shopping: $500

- Savings & Debt (20%) = $800

- Emergency Fund: $200

- Student Loan Repayment: $300

- Roth IRA Contribution: $300

Budgeting That Feels Good, Not Restrictive

The 50/30/20 rule is a powerful budgeting method because it brings balance and sustainability. You’re not giving up everything you enjoy — you’re organizing your income in a way that supports both your present lifestyle and your future stability.

Start by calculating your income, reviewing your expenses, and dividing them into these three categories. Even if you can’t follow it exactly, getting close is a win.

Budgeting isn’t about perfection — it’s about progress. And this rule makes it easier to stay consistent.

In God We Trust